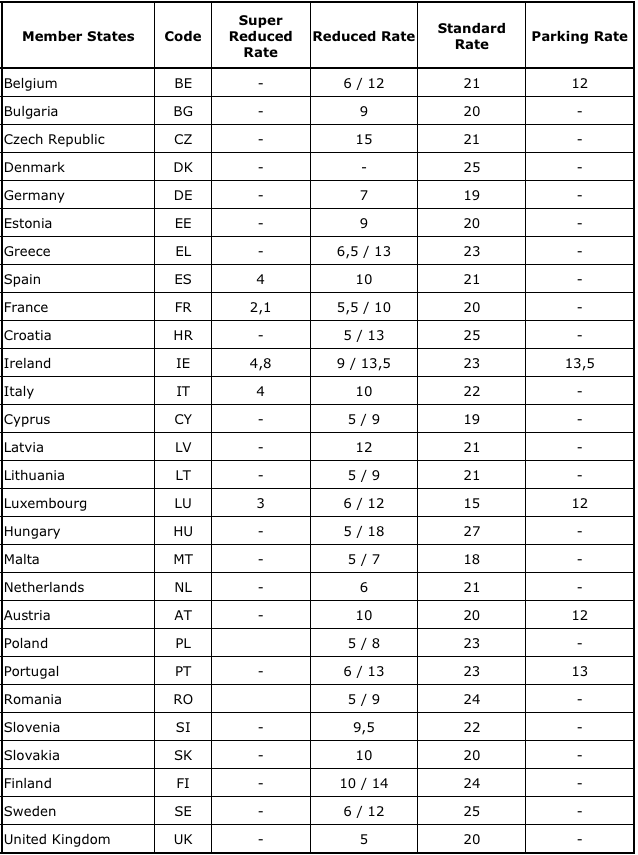

Segmented European Union VAT rates in force from January 1, 2015

The European Commission has applied a radical reform to the VAT rules for all telecommunications, broadcasting and electronic (including web hosting) services distributed within the European Union.

According to the new rules, customers will be imposed segmented VAT rates depending on the country they come from, not on the country where the provider is headquartered.

The new change is aimed at creating a fair competitive environment for all companies on the EU market and will take effect on January 1st, 2015.

What imposed the new EU VAT rules?

This radical change to the VAT regulations is explained by the European Commission’s policy towards providing foreign investors with equally competitive conditions in all EU countries.

The new ‘destination principle’ in VAT formation states that companies must pay VAT in the countries they deliver services rather than the country they are headquartered in.

This would prevent large overseas companies like Google and Amazon from taking advantage of the low VAT levels in Luxembourg, where they are based in Europe.

Since the customer’s whereabouts now take precedence over the provider’s location, the new rule will result in differences in the VAT rates for customers who pay for the delivered services.

Who will be affected by the new EU VAT rules?

As it has been until now, only individuals located in the European Union will be subject to a VAT charge atop the purchased web hosting service’s value.

This time around, however, customers from all EU member countries will not be charged a flat rate of 20% (the UK VAT rate that LiquidNet Ltd. has so far had to comply with as a UK-registered company).

Instead, customers will be charged a VAT fee based on the country they come from themselves. This way, a customer based in Luxembourg (VAT=17% from January 1st, 2015) will pay less than a customer in Ireland (VAT=23%), for example, because of the huge difference in the VAT policies of the two countries.

NOTE: The new VAT charges will apply to all payments through PayPal, a credit card or a bank wire, with no exception.

The following is a list of the VAT rates in the different EU member states:

A very helpful article, thank you.